Washing machine depreciation calculator

Grading and packing line assets used on farm. How do you calculate depreciation on a washing machine.

How To Calculate Depreciation Expense For Business

AGRICULTURE FORESTRY AND FISHING.

. By subtracting the residual value from the original cost and dividing it by the number of years you anticipate using the equipment you will be able to ascertain the yearly amount of depreciation. Calculate Washing Machine Power Consumption. CBIC GUIDELINES ON PROSECUTION UNDER GST LAW.

Depreciation Calculator The calculator should be used as a general guide only. Prime Cost Rate. One of the most common ways to calculate out what is generally regarded as fair compensation in a case like this is to take the original purchase price divide it by the number.

Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. Step 6 Multiply the yearly depreciation value that you. Since it costs less than 2500.

Select the appliance from the list or enter the depreciation rate directly. 1 Reply Carl Level 15 June 11 2020 851 AM Depreciating a washing machine over 5 years will not make one bit of difference to your tax liability. Those for domestic use like they are used in Europe are built.

You can calculate the appliance depreciation using the above equation. It may depend which washing machines you are talking about. Carpet upholstery and rug cleaning services assets.

Divide the depreciable base by the number of years in the expected lifespan of the machine to calculate each years depreciation. Interest is leviable despite the. Laundry and dry cleaning services.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Rated Power Of Your Appliance Watt 1 Kilowatt 1000 Watt Daily Operational Hours Hours Electricity. There are many variables which can affect an items life expectancy that should be taken into consideration.

Air purifiers deodorising and mould. Follow the steps below. The following formula can be used to calculate appliance depreciation.

There are many variables which can affect an items life expectancy that should be taken into consideration. 7000 purchase cost 10 years x 12 months depreciation expense 7000 purchase cost 120 months 58 depreciation expense each month For the accelerated depreciation method. The Depreciation Guide document should be used as a general guide only.

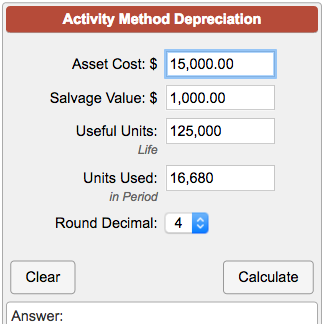

Depreciation Rate Initial Cost of the Machine Number of Working Hours per YearAmortization Period Mt Cmachine NwhAP This formula uses 4 Variables Variables Used Depreciation. THRESHOLD LIMIT FOR PROSECUTION ARREST AND BAIL UNDER CUSTOMS ACT 1961. The Depreciation Guide document should be used as a general guide only.

Replacement Cash Value Replacement Cash Value X Appliance Age X Depreciation Rate Current Cash Value What. There are many variables which can affect an items life expectancy that should be taken into consideration.

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

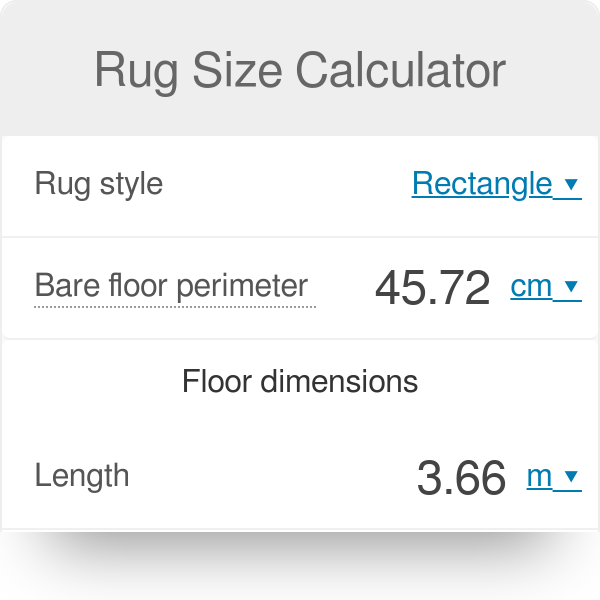

Rug Size Calculator

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

How To Calculate Amortization On Patents 10 Steps With Pictures

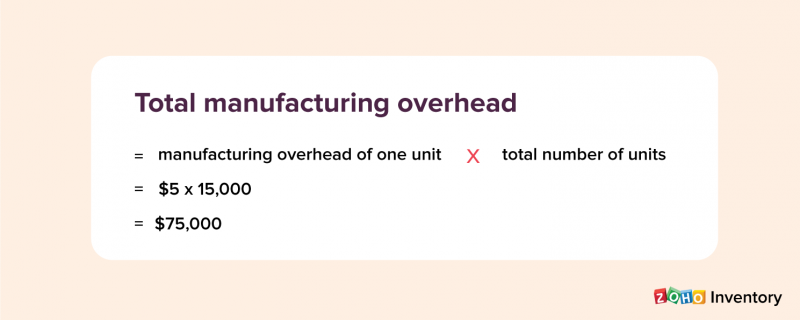

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Pin By Carissajane On Cam Graphing Calculator Graphing Calculator

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Depreciation Rate Calculator Online 55 Off Www Alforja Cat

Ybf98ddoflkb1m

Depreciation Rate Calculator Online 55 Off Www Alforja Cat